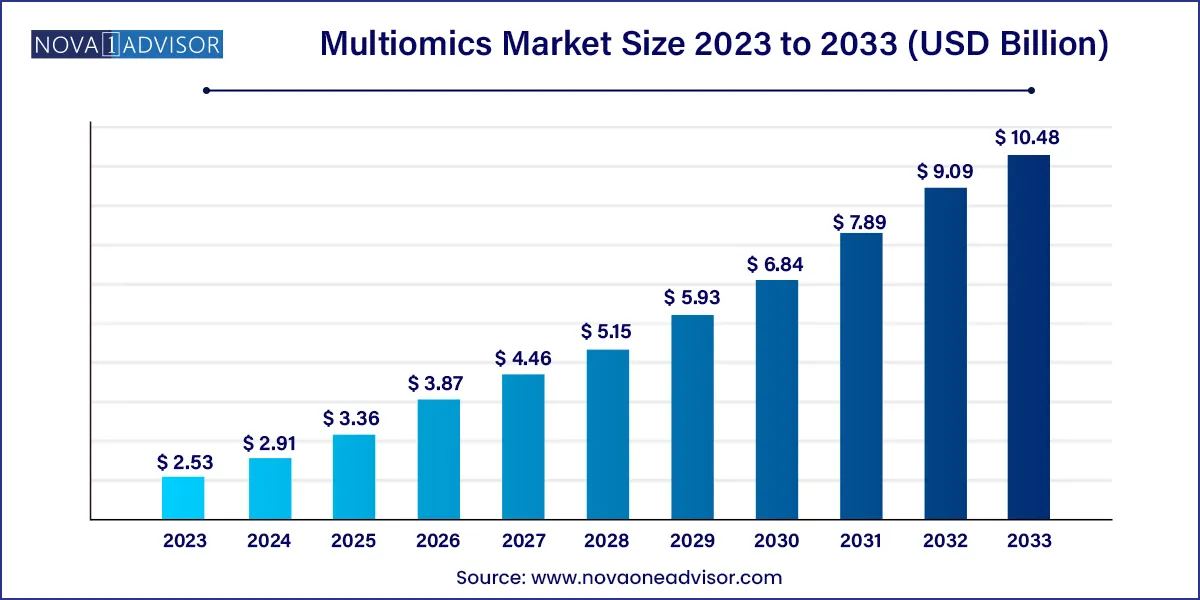

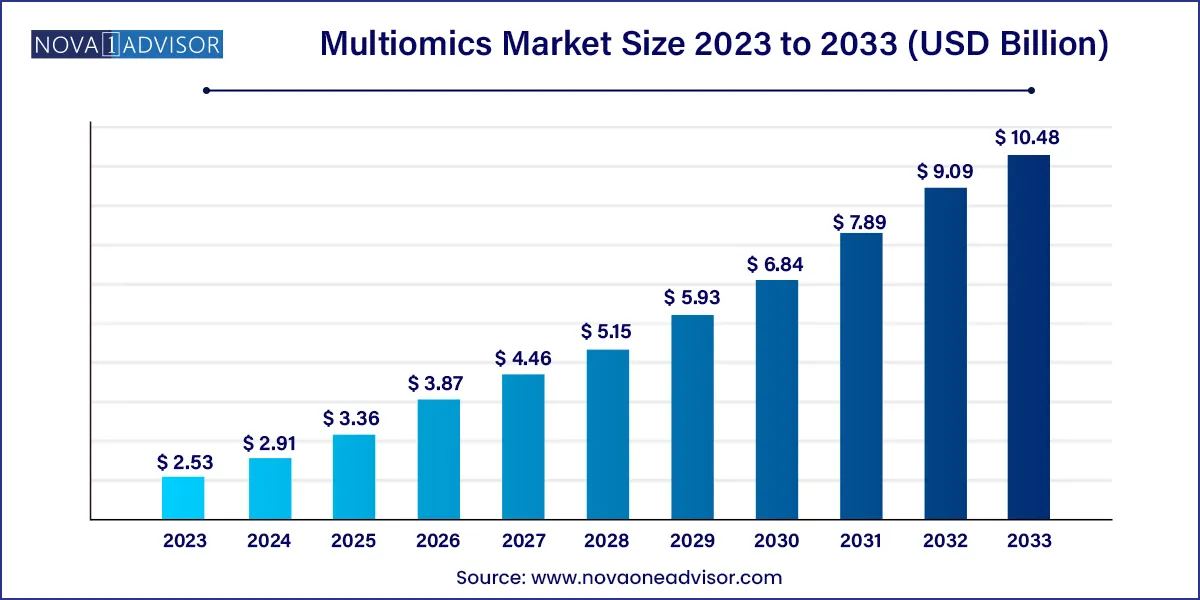

The global multiomics market size was estimated at USD 2.53 billion in 2023 and is projected to hit around USD 10.48 billion by 2033, growing at a CAGR of 15.3% during the forecast period from 2024 to 2033.

Key Takeaways:

- North America dominated the market with a share of 49.45% in 2023, and the region is projected to register the fastest growth throughout the forecast period.

- Asia Pacific is expected to grow at a significant CAGR of 17.8% from 2024 to 2033.

- The product segment accounted for the largest market share of 61.19% in 2023.

- The service segment is projected to grow at the fastest CAGR of 17.4% from 2023 to 2033.

- The bulk multiomics segment dominated the type segment in 2023.

- The single-cell multiomics segment is anticipated to witness the fastest CAGR of 17.9% during 2023-2033.

- The genomics segment dominated the market with a revenue share of 41.16% in 2023.

- The metabolomics segment is projected to exhibit the fastest growth with a CAGR of 17.6% from 2023 to 2033.

- The cell biology segment dominated the market with a revenue share of 38.8% in 2023.

- The oncology segment is projected to exhibit the fastest growth with a CAGR of 18.0% from 2023 to 2033.

- The academic and research institutes segment captured the largest market share of 52.7% in 2023.

- The pharmaceutical and biotechnology companies segment is projected to register the fastest CAGR of 17.5% from 2024 to 2033

Market Overview

The global Multiomics market has emerged as a transformative segment in biomedical and life sciences, integrating various omics technologies such as genomics, proteomics, transcriptomics, metabolomics, and epigenomics to provide holistic biological insights. This multidisciplinary approach has gained immense traction in recent years due to its potential to unravel the complexities of diseases, especially cancer, neurological disorders, and autoimmune conditions. Multiomics facilitates simultaneous analysis at multiple molecular levels, enabling a systems biology perspective for diagnostics, therapeutic development, and personalized medicine.

The rise of high-throughput technologies, coupled with significant advancements in artificial intelligence (AI) and bioinformatics tools, has significantly boosted the adoption of multiomics strategies in both academic and commercial research. Pharmaceutical and biotechnology companies are increasingly deploying multiomics to accelerate drug discovery, optimize clinical trials, and predict patient responses to therapies more accurately.

With increasing healthcare investments, expanding applications in oncology and cell biology, and technological innovation in omics platforms, the Multiomics market is poised for robust growth over the next decade. As data complexity grows, the integration of omics layers into a cohesive pipeline continues to be both a challenge and an opportunity for players in this field.

Major Trends in the Market

-

Rising integration of AI and machine learning in multiomics data analysis to enable real-time insights and predictive modeling.

-

Expansion of single-cell multiomics to understand cellular heterogeneity, particularly in cancer and neurodegenerative diseases.

-

Growing partnerships and collaborations between academic institutions and biotech firms to co-develop omics platforms.

-

Development of cloud-based bioinformatics platforms for multiomics data storage, sharing, and analytics.

-

Increased adoption of multiomics in personalized and precision medicine to tailor therapies based on a patient’s multi-layered molecular profile.

-

Shift towards multiomics services among pharmaceutical companies to reduce infrastructure cost and shorten research timelines.

-

Emergence of integrated omics solutions combining genomics, transcriptomics, and proteomics for biomarker discovery.

Multiomics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.91 Billion |

| Market Size by 2033 |

USD 10.48 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.3% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product & service, type, platform, application, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI |

Market Driver: Growing Focus on Precision Medicine

One of the most influential drivers shaping the Multiomics market is the growing emphasis on precision medicine. Precision medicine relies heavily on understanding disease mechanisms at the molecular level, for which multiomics is indispensable. Rather than adopting a “one-size-fits-all” approach, multiomics allows researchers and clinicians to tailor treatments based on an individual’s genetic makeup, proteomic expression, and metabolic profiles.

For instance, in oncology, multiomics enables identification of actionable mutations, resistance mechanisms, and predictive biomarkers. This has allowed therapies like immuno-oncology drugs and targeted inhibitors to be selected more effectively. Furthermore, the increasing availability of biobanks and patient registries has enriched the ability to validate omics findings across diverse populations, thereby reinforcing the clinical utility of multiomics.

Market Restraint: High Costs and Complexity

Despite its promise, the Multiomics market faces substantial hurdles, chief among them being the high cost and operational complexity associated with implementing multiomics solutions. The need for advanced instruments, vast computational infrastructure, and highly skilled personnel makes multiomics adoption financially prohibitive for many smaller institutions and hospitals.

Moreover, integrating data from various omics layers involves sophisticated bioinformatics pipelines and standardization challenges. Differences in data formats, sample handling protocols, and analytical tools can lead to inconsistent results, impeding reproducibility and cross-study comparisons. These complexities, combined with regulatory concerns surrounding data privacy and sharing, present a significant barrier to market growth, especially in developing economies.

Market Opportunity: Expansion into Clinical Diagnostics

A significant growth opportunity lies in the integration of multiomics in clinical diagnostics. While multiomics has traditionally been confined to research settings, its potential in early disease detection, prognosis assessment, and therapy selection is drawing increasing attention in clinical practice.

For example, companies are now developing blood-based multiomics tests that can detect early-stage cancer or assess cardiovascular risks. In 2023, a European startup launched a multiomics diagnostic panel for early Alzheimer’s detection, combining genomic risk markers, transcriptomic profiles, and proteomic biomarkers. As regulatory pathways become clearer and cost-effective platforms emerge, the clinical diagnostics segment is likely to witness widespread adoption of multiomics technologies, thus unlocking a new revenue stream for market players.

By Product & Service Insights

Consumables dominated the Multiomics market in 2024 due to the repetitive and essential nature of these products in every experiment, including reagents, kits, probes, and sample preparation solutions. As multiomics studies often require extensive validation and repeated experimentation, demand for consumables remains high. Additionally, the increasing frequency of high-throughput omics studies and clinical sample testing in pharmaceutical settings further amplifies the need for high-quality, reproducible consumables. Companies like Qiagen and Thermo Fisher Scientific continue to expand their consumables portfolios with application-specific products tailored for integrated omics workflows.

On the other hand, Services are emerging as the fastest-growing segment, driven by a rising trend among biotech firms and academic institutions to outsource multiomics studies. Specialized service providers offer end-to-end multiomics solutions, from sample collection and sequencing to data analysis and interpretation. This model is particularly attractive to smaller research institutions lacking internal infrastructure. Contract research organizations (CROs) have started offering multiomics as a bundled service, supporting drug discovery and biomarker research with a cost-effective and faster alternative to in-house R&D setups.

By Type Insights

Bulk Multiomics currently holds the largest share in the market due to its widespread use in population-scale studies and tissue-based analysis. Bulk analysis allows researchers to profile entire tissue or blood samples, providing average omics signals across cell populations. These approaches are still vital for longitudinal studies and epidemiological research where population-wide data is essential. Additionally, bulk multiomics platforms are relatively cost-effective and more accessible, making them the default choice in many large-scale research projects.

Conversely, Single-cell Multiomics is experiencing exponential growth owing to its unparalleled resolution in dissecting cellular heterogeneity. Single-cell platforms have been revolutionary in cancer research, where understanding rare subpopulations of malignant or immune cells can influence therapy. Technologies enabling concurrent measurement of gene expression, chromatin accessibility, and protein markers at the single-cell level have become increasingly sophisticated. In April 2024, a U.S.-based startup announced a single-cell multiomics kit capable of processing 1 million cells in a single run, indicating the rapid progress in this area.

Genomics remains the dominant platform in the multiomics market due to its foundational role in biological research. Genome sequencing is often the first step in multiomics workflows, enabling mutation detection, variant analysis, and genome-wide association studies (GWAS). Over the years, decreasing sequencing costs and the widespread availability of next-generation sequencing (NGS) platforms have made genomics a cornerstone of omics-based studies.

However, Integrated Omics Platforms are the fastest-growing platform category, driven by the need for holistic biological insights. These platforms allow researchers to simultaneously analyze genomics, proteomics, transcriptomics, and metabolomics data, offering a comprehensive picture of disease mechanisms. For instance, in April 2024, a leading bioinformatics firm launched a cloud-based multiomics dashboard that integrates data pipelines across platforms, supporting real-time analysis and visualization. Such tools are reshaping how multiomics data is processed and interpreted.

By Application Insights

Oncology is the leading application segment for multiomics technologies, accounting for a significant market share. Cancer is inherently a multi-faceted disease with genetic, epigenetic, and environmental layers influencing progression and therapy response. Multiomics approaches have been pivotal in stratifying patients, identifying novel drug targets, and predicting immunotherapy responses. Major cancer research initiatives, such as The Cancer Genome Atlas (TCGA), utilize multiomics data to generate molecular classifications and guide treatment development.

Meanwhile, Neurology is fast emerging as a promising application area. Neurodegenerative diseases such as Alzheimer’s, Parkinson’s, and ALS involve complex pathophysiological changes that require multi-dimensional insights. In January 2024, a European neuroscience consortium launched a multiomics biomarker study aimed at identifying early-stage Alzheimer’s markers using transcriptomic and metabolomic profiling. These developments signal growing interest and investment in applying multiomics to brain research.

By End-use Insights

Academic and Research Institutes are currently the largest users of multiomics technologies. These institutions conduct foundational biological research that often sets the stage for therapeutic innovations. Funding from government agencies, non-profit organizations, and academic-industry partnerships sustains high volumes of multiomics projects. Initiatives such as the NIH’s “Bridge2AI” program, which began in 2023, continue to support large-scale omics data integration projects in academic settings.

Pharmaceutical and Biotechnology Companies, however, are the fastest-growing end-users as they increasingly adopt multiomics to streamline drug discovery, identify new targets, and optimize clinical trial outcomes. In March 2024, a U.S. pharma giant announced its partnership with a bioinformatics company to incorporate multiomics data into its oncology pipeline, indicating the commercial sector’s growing interest in these technologies.

By Regional Insights

North America dominated the Multiomics market in 2024, holding the largest revenue share due to its mature healthcare infrastructure, robust R&D ecosystem, and significant government and private sector investments. The U.S., in particular, is home to numerous academic institutions, biobanks, and life science companies actively engaged in multiomics research. NIH grants, FDA support for omics-based diagnostics, and collaborations between academia and industry foster a highly conducive environment for multiomics growth. Additionally, the presence of technology leaders such as Illumina, Thermo Fisher Scientific, and Bio-Rad strengthens the regional market dynamics.

Asia-Pacific Emerges as the Fastest Growing Region

Asia-Pacific is witnessing the fastest growth in the multiomics market, driven by rising healthcare expenditures, growing biotechnology sectors, and supportive government initiatives in countries like China, India, and Japan. For example, in 2023, China’s Ministry of Science and Technology launched a multiomics-based precision medicine initiative aimed at integrating omics datasets into national health systems. Similarly, Indian biotech firms are investing heavily in omics platforms for drug discovery and agricultural genomics. The rapidly expanding population base and increasing burden of chronic diseases make the region highly attractive for multiomics adoption.

Some of the prominent players in the Multiomics Market include:

- BD

- Thermo Fisher Scientific Inc.

- Illumina, Inc

- Danaher

- PerkinElmer Inc.

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI

Recent Developments

-

January 2024: 10x Genomics announced a new product launch called “Visium HD,” which combines spatial transcriptomics and proteomics, enhancing the resolution of tissue mapping applications.

-

March 2024: Thermo Fisher Scientific partnered with a biotech startup to develop a cloud-native multiomics platform that integrates genomics, proteomics, and metabolomics in a seamless workflow.

-

April 2024: Illumina Inc. introduced a new software tool aimed at simplifying the integration of omics data in clinical diagnostics applications, supporting both regulatory submissions and biomarker discovery.

-

February 2024: QIAGEN expanded its portfolio by acquiring a multiomics data analytics firm to strengthen its capabilities in bioinformatics and clinical diagnostics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Multiomics market.

By Product & Service

- Products

- Instruments

- Consumables

- Software

- Services

By Type

Single-cell Multiomics

Bulk Multiomics

By Platform

- Genomics

- Transcriptomics

- Proteomics

- Metabolomics

- Integrated Omics Platforms

By Application

- Cell Biology

- Oncology

- Neurology

- Immunology

By End-use

- Academic and Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)